Home Care Pulse,

Home Care Pulse leads the home care industry in experience management, performance benchmarking, caregiver training, and reputation management. On behalf of home care agencies across North America, Home Care Pulse surveys over 300,000 clients and caregivers, and provides training to engage, retain, and improve outcomes for post-acute agencies. Home Care Pulse also provides tools for agencies to monitor, improve, and generate more online reviews; conducts the annual Home Care Benchmarking Study, the most comprehensive survey of home care providers in North America; and administers the annual Best of Home Care awards to agencies that achieve best-in-class client and caregiver satisfaction scores.What You Need to Know About M&A’s to Grow Your Agency (+ Other Growth Strategies)

By Home Care Pulse | November 30, 2021

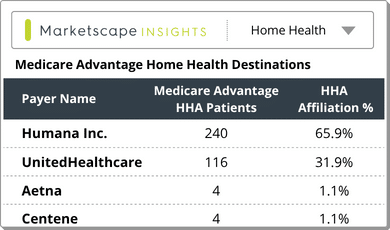

In most specialized industries, a swell of companies compete for attention in the same customer pool, trying to attract a limited number of clients. Not so in the booming home health care market, where those in need of the service are expanding at a far quicker pace than those providing the service.

The money is flowing freely right now and corporate activity is peaking, as agencies and investors across the U.S. look to seize on the incredible momentum within home care – whose importance in this industry’s landscape has been laid bare by the pandemic.

“This is why we see private equity so fascinated with home care,” says Atlanta-based Angelo Spinola, a lawyer with Polsinelli with a special interest in home health care. “That’s why we see the movement in the industry, the excelling rate of mergers and consolidation, and agencies expanding their operations to meet diverse client needs and differentiate so they become attractive to top referral sources.”

Indeed, becoming a go-to referral source is one of 10 essential growth strategies laid out in a new report co-produced by AlayaCare, Polsinelli, and Home Care Pulse. It is an important time for growth-oriented agencies to make the right decisions and, to that end, we’d also invite you to watch our recent webinar below on growth strategies that dove into an array of key subjects – from employee retention to attracting investors.

A direct path to scaling is seizing the escalating trend of mergers and acquisitions (M&A), in an industry brimming with such activity. It can be an attractive option for growth but must be approached strategically whether one is an acquirer or acquiree.

To Merge or Not to Merge

Angelo says that the road to M&A in home care begins with a lot of planning, and a keen understanding of one’s growth strategy. How do you know, for instance, if franchising is the right model, instead?

Often in franchising, smaller agencies don’t have the up-front capital to acquire, so their growth is reliant on franchisees fielding those start-up costs while the brand expands. This is often an attractive model of growth and franchising often brings strong local connections as the brand grows through regions. Still, this strategy requires maintaining close relationships between franchisor and franchisee, navigating tension conflict, and sharing resources appropriately.

This is to say that agencies should explore all growth moves to find the ideal path for them. For many reasons, M&As may be that avenue, particularly in a time when large home care entities are acquiring smaller ones that may bring possibly specialty services to the fold that help one organization start to broaden the scope and differentiate itself from the pack.

“Buyers outnumber sellers, so many smaller agencies that didn’t consider M&As may start to now, while they also look very attractive to larger agencies in search of a collateral service arm that complements what they do,” Angelo says. “From medical to non-medical care, there is a desire to grow and be able to support each client on as many levels as possible.”

These days, he says, the idea is to not only plan an M&A but to actually integrate one agency into another in a timely fashion. Smaller agencies are attractive now because they offer such flexible integration and a new footprint into different communities – and infusing resources and strategies and systems into them propels growth more quickly than the years it might take two large agencies to unite operationally.

M&As are about the Future and the Right Sync

First, it’s important to determine if M&A is the correct strategy for each individual agency and, following that, it is vital that the right partnership be struck so as to avoid any risk to reputation or ability to deliver quality care. Perform all the due diligence necessary, and be as strategic as possible.

Angelo suggests that acquirers worry less about an agency that has a certain amount of revenue potential and more that it merges and fits well into their current business model and values. This requires plenty of analysis. “And for acquirees,” he says, “it’s best to identify business goals in advance of an M&A, and then really scrutinize potential suitors. Spark early conversations about what the future looks like and if true integration is possible, long before a deal is on the table.”

Data underpins successful M&As, as technology can ensure full visibility into what’s happening right now, and what may happen with the broadened operations. Data tied to key performance indicators also help transparently prove that an agency is hitting the targets they believe are essential to success as it relates to clients, employees, operations, and revenue. Having a system that collects and collates important metrics ensures that nobody has to take anyone’s word for it amidst such a high-stake major move as an M&A.

There is plenty more to say on this huge, timely, important subject – and we encourage you to watch the recent expert panel to learn more on M&As as well as other realistic growth strategies in home care.

For more information, visit https://www.homecarepulse.com/.