Data-driven decision-making is no longer optional; it’s essential. As Medicare Advantage (MA) continues to outpace traditional Medicare in enrollment growth, understanding how and where MA patients enter the care continuum is critical. Healthcare organizations that leverage payer-specific referral insights, especially those focused on MA, can uncover high-value opportunities to strengthen provider partnerships and drive patient volume.

Why MA-Specific Referral Data Is a Go-to-Market Advantage

Historically, referral data has lacked granularity at the MA payer level. Most referral tracking systems aggregate all patients together, making it difficult to distinguish between Medicare Advantage enrollees and traditional Medicare or commercial plan patients. This lack of payer specificity limits the ability to develop targeted growth strategies.

In the current value-based care environment, where financial incentives and care coordination requirements vary by payer, understanding the flow of MA patients is particularly important.

For leaders planning their MA go-to-market strategy, it’s critical to know where hospital MA patients are being referred — segmented by agency and payer. Users should look for key metrics such as annual patient counts by MA payer to analyze affiliation strength, patient volume, and payer alignment to then assess competitive positioning.

Finding the Right Referral Sources

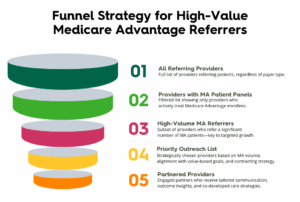

Not all referrals have equal strategic value. By identifying hospitals and physicians who refer high volumes of MA patients, healthcare providers can target referral sources most aligned with their Medicare Advantage growth initiatives.

It is important to get a granular view of referral behavior, showing not only who is referring MA patients, but how those referrals move through the care continuum.

By looking at the annual MA patient count, leaders can quickly identify higher-value referral sources who are actively engaged with the MA population. This not only clarifies patient volume trends but also helps create a prioritized referral list aligned with MA growth and contracting goals.

Need help with your MA contracting strategy? Click here to learn more.

Understanding Payers at the Physician Level

Analyzing payers at the individual physician level is critical for targeted outreach. It is important to understand the proportion of Medicare Advantage versus traditional Medicare patients seen by specific providers.

This information helps healthcare organizations identify which physicians have MA-heavy patient panels and thus may be more receptive to collaborations focused on the Medicare Advantage population.

By identifying providers most aligned with their growth strategies, organizations can prioritize MA-heavy physicians, customize outreach messages, and build partnerships that improve care coordination.

By identifying providers most aligned with their growth strategies, organizations can prioritize MA-heavy physicians, customize outreach messages, and build partnerships that improve care coordination.

Prioritizing Outreach Based on MA Volume

Segmenting provider lists based on Medicare Advantage referral volume and growth potential creates a more strategic approach to outreach.

By segmenting payer–specific volume trends, users can see where hospitals are sending MA patients – broken down by Home Health Agency or SNF, with affiliation %, patient volume, and payer breakdowns.

This helps organizations discover new referral opportunities, understand competitive positions, and align marketing and contracting with top-tier MA partners.

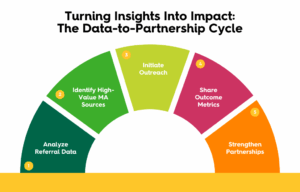

Closing the Loop: From Data to Partnerships

Closing the Loop: From Data to Partnerships

Referral data is only as powerful as the partnerships it helps build. To foster strong, lasting relationships with referring providers, healthcare organizations must share meaningful insights and demonstrate mutual value.

Trella Health’s Latest MA Data supports this process by enabling providers to track referral outcomes and patient success metrics linked to Medicare Advantage populations.

Sharing these insights with referring physicians and hospitals creates transparency, builds trust, and encourages collaborative efforts focused on delivering high-quality, cost-effective care.

With Trella’s enhanced MA data, you don’t just track referrals—you unlock the intelligence to grow smarter, partner better, and lead in a competitive MA landscape.

Conclusion

The Medicare Advantage market is rapidly evolving, and healthcare organizations must adapt by leveraging payer-specific referral data to drive growth. Solutions like Trella Health’s Latest MA Data provide the granular, actionable insights necessary to identify high-value MA referral sources, understand payers, and prioritize outreach that aligns with value-based care goals.

By integrating this data into growth strategies, providers can strengthen partnerships, improve patient care, and thrive in the increasingly competitive healthcare environment.

To learn more about Trella Health’s Latest MA Data, click here.