Carter Bakkum, Senior Data Analyst, Healthcare Insights

Carter is a senior data analyst who works to turn complex, messy data into actionable intelligence. Carter studied economics and statistics at the University of Virginia before joining an economic consulting firm, where he supported expert testifying economic witnesses on behalf of fortune 500 healthcare companies. After the significant changes in the importance of data analytics during the pandemic, Carter joined the Trella team to dive deeper into the numbers to uncover the stories that drive our experience.Sneak Peek into the Post-Acute Care Industry Trend Report

By Carter Bakkum | March 18, 2022

A national view on Medicare spending and utilization

Shifts towards value-based care and an influx of baby boomer beneficiaries promises a multitude of opportunities for home health, hospice, and skilled nursing organizations to grow. However, staffing challenges threaten to strain the PAC industry to its breaking point, creating a cascade of effects for health systems, ACOs, and others.

Our full analysis and commentary will be published in the Post-Acute Care Industry Trend Report in late March. In the meantime, we’re sharing a few of the initial trends that emerged in our analysis.

Trend Highlights:

- Inpatient discharge instructions to post-acute care agencies returned to pre-pandemic levels. Discharges were much more likely to be referred to home health services agencies than skilled nursing facilities.

- Quarterly home health and skilled nursing admissions stabilized below pre-pandemic levels. However, utilization and adherence metrics point to an inadequate supply of PAC services driven by particularly high resignation rates across healthcare workers.

- At its current growth rate, Medicare Advantage enrollment is set to eclipse 50% of eligible Medicare beneficiaries in 2025. MA penetration varies significantly by geography, with evident MA preference for densely populated urban areas.

Shifting Preferences for At-Home Care

The percentage of inpatient discharges with instructions to seek post-acute care services increased from 51.1% in 2019 Q3 – 2020 Q2 to 52.2% in 2021 Q4 – 2021 Q3 reporting period, respectively. Referral destinations, however, moved drastically in favor of at-home care. Between the rolling four quarters ending in 2020 Q2 and 2021 Q3, home health instructions increased 2.5 percentage points to 24.1% of inpatient discharges while skilled nursing instructions declined 2.4 percentage points to 18.6%.

What does this mean for my home health and skilled nursing agency?

Home health agencies should capitalize on shifting patient and physician preferences to solidify their position as the go-to post-acute care destination. Significant investment in staff acquisition and retention should be the utmost priority to ensure every instruction is answered. A dismal adherence rate of 71.9% to home health instructions must be addressed in order to grow home health business.

In addition to staffing challenges, skilled nursing facilities face a PR crisis. Fears of SNFs turning into COVID-19 hotspots likely contributed to the significant decline in PAC discharge instructions to SNFs. Individual skilled nursing agencies should return their focus to SNFs core value proposition: around-the-clock post-acute care and decreased hospitalizations for beneficiaries at risk of inpatient readmission.

Medicare Advantage Enrollment Continues to Grow

To say Medicare Advantage enrollment has picked up steam is an understatement. MA enrollment looks more like a freight train at top speed rushing to cover every beneficiary eligible for Medicare. As of February 2022, national MA penetration reached 44.6% and CMS’ recent doubling of the Medicare Advantage hospice carve-in, MA looks poised to take over every aspect of traditional Medicare coverage.

What does this mean for my PAC agency?

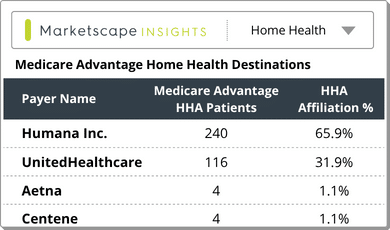

While national MA penetration continues to grow, counties and states continue to see highly variable populations of MA enrollees. Local MA beneficiary enrollment and physician-level information on patients covered by MA plans is essential in developing a strategy for handling MA growth in an individual market.

Stay tuned

For more insights into these trends and many more topics – including telehealth utilization, pandemic-induced PAC turnover, PAC utilization, and much more – keep an eye out for Trella’s Post-Acute Care Industry Trend Report to be published in late March.

I will be speaking about our findings on an upcoming webinar hosted by Home Health Care News along with our Director of Data Science, Mike Neuman, and Home Care Pulse’s Chief Operating Officer, Todd Austin. Register here.

Trella Health is the leader in market intelligence for the 65+ population, with extensive data sets including Medicare FFS, Medicare Advantage, commercial payers, ACOs, and DCEs. For more insights into how to stand out as a preferred referral partner, schedule a demo today.