As the healthcare system continues its shift toward value-based care, the post-acute care (PAC) industry finds itself at a critical juncture. Driven by demographic trends and shifting patient preferences, the landscape is more dynamic than ever. Providers must remain vigilant to navigate these transformations effectively for better patient outcomes and health outcomes.

From Trella Health’s 2025 Post-Acute Care Industry Trend Report, we highlight 10 emerging healthcare trends that will shape strategy and decision-making across skilled nursing facilities, home health care agencies, and hospice care. From Medicare Advantage growth to home-based care utilization, these trends signal where innovation, alignment, and operational agility will be most critical among various healthcare facilities.

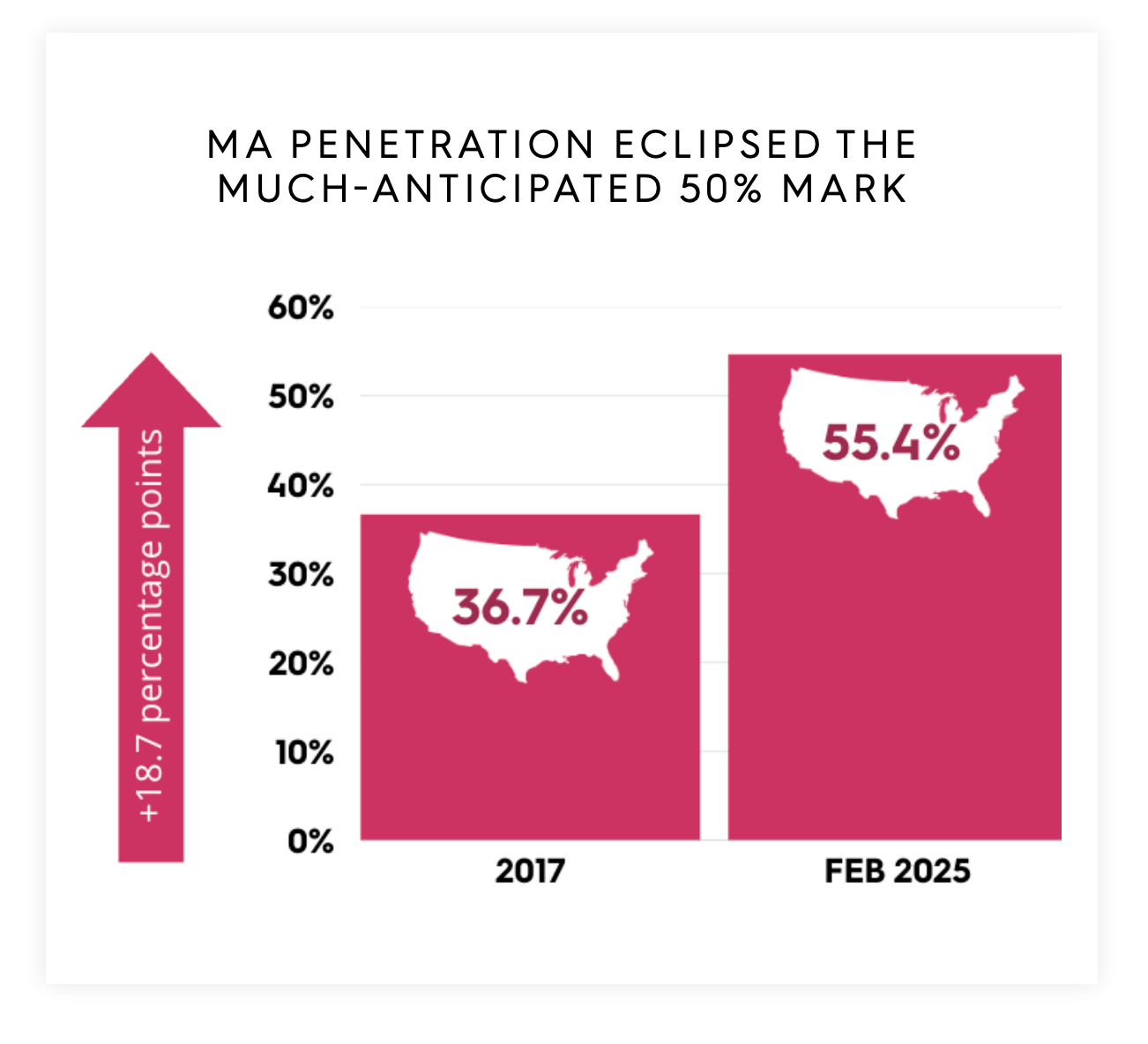

1. Medicare Advantage Penetration Crosses 55%, But Growth Slows

Medicare Advantage (MA) continues its upward trajectory, with national MA penetration reaching 55.4% of Medicare beneficiaries in early 2025. However, the rate of growth has decelerated to just 0.6 percentage points year-over-year, the slowest since 2016.

This shift suggests market saturation in key states and highlights a pivot toward quality over quantity for MA plans. For post-acute care providers, especially home health care providers and skilled nursing agencies, aligning with MA plan expectations around value, outcomes, and network performance is now essential, not optional.

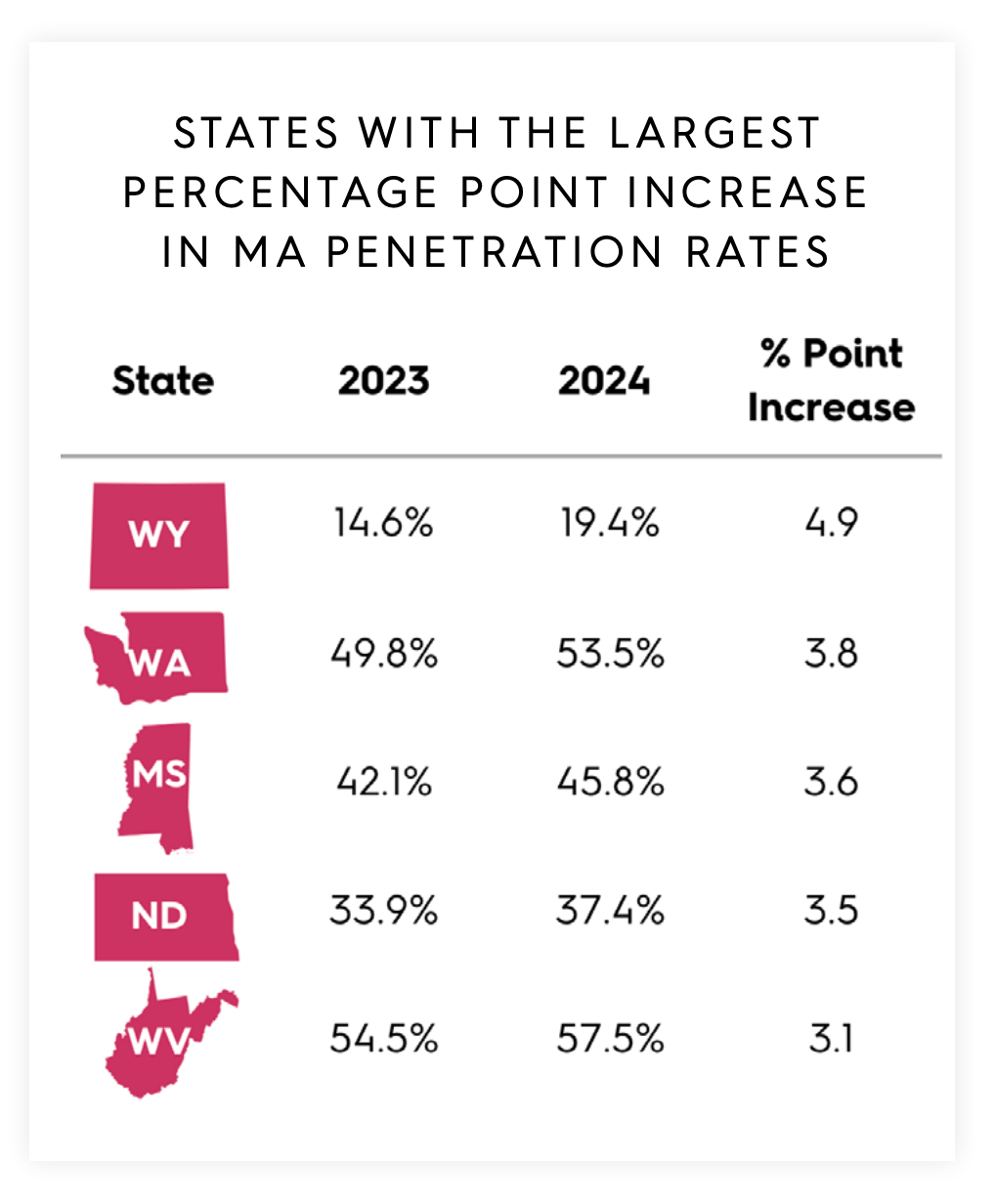

2. Geographic Shifts in MA Penetration Highlight Localized Opportunity

While national growth slowed, MA penetration increased in 45 states and DC. States like Wyoming, Washington, and West Virginia posted year-over-year increases exceeding 3.1 percentage points, suggesting a targeted expansion of MA plans in rural and historically underserved areas.

Home health agencies and skilled nursing facility providers in these regions should prioritize local market intelligence and payer alignment to remain competitive. Strategic positioning within high-penetration states, where 30 states now exceed 50% MA enrollment, is becoming increasingly vital.

3. The Rise of PPOs Redefines Post-Acute Care Strategy

Between 2020 and 2024, PPO plan enrollment grew 15.3% annually, more than double the rate of HMOs. This transition has profound implications: PPO beneficiaries use home health services at lower rates (7.0% vs. 7.7% for HMOs), reflecting a potentially steeper climb for agencies seeking to prove value in these more flexible networks.

Providers must adopt outcomes-driven marketing, reinforce quality metrics, and leverage local performance data to optimize their position within expanding PPO ecosystems.

The growing demand for home health care is placing pressure on agencies to differentiate themselves through efficiency, data transparency, and partnerships with flexible pay networks.

4. Stabilization in Discharge Patterns Signals Emerging Post-Pandemic Norms

After pandemic-driven volatility, inpatient discharge instructions to PAC settings increased to 52.9%, matching pre-2022 levels. Most of this growth stems from home health referrals, which rose 0.5 percentage points year-over-year.

These developments indicate that hospitals and health systems are regaining operational footing, while patient preferences continue shifting toward care-at-home models. Providers able to facilitate seamless transitions will stand out in the value-based care landscape.

Additionally, the increased focus on care delivery in the patient’s home highlights the broader shift away from institutions care in favor of more comfortable, personalized alternatives.

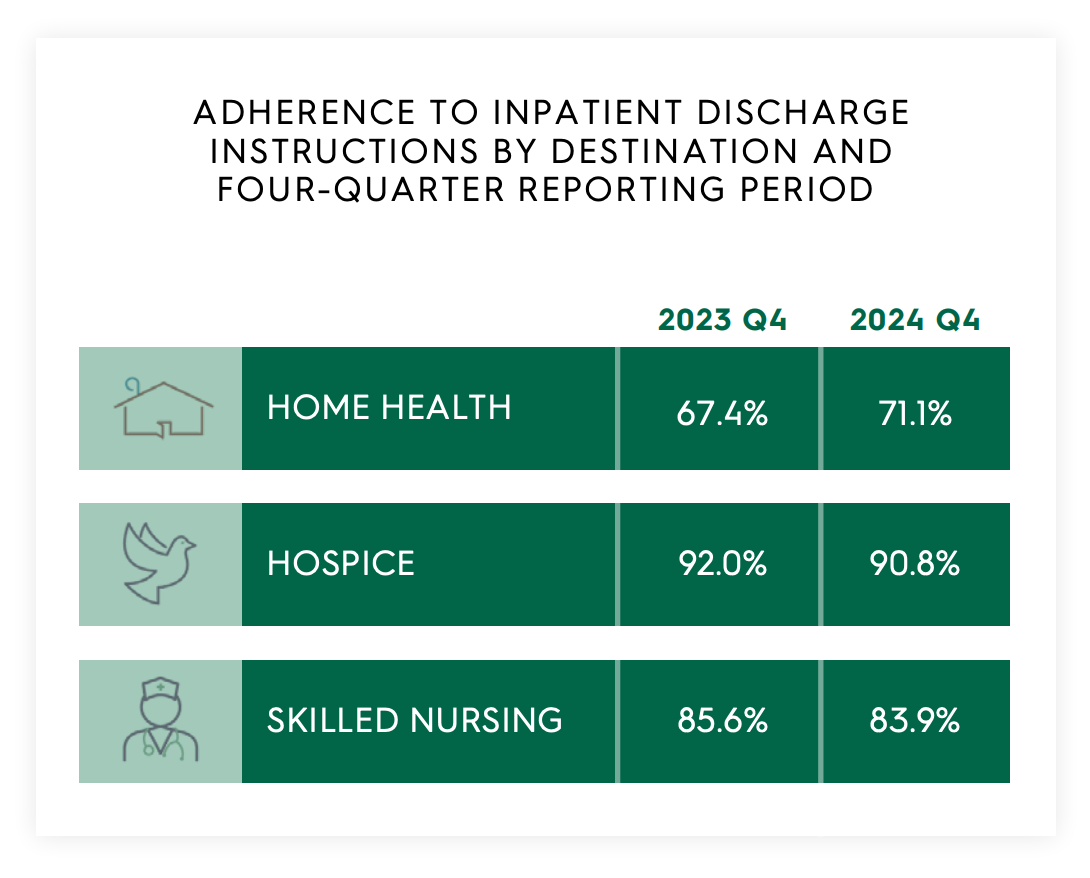

5. Home Healthcare Agencies Adherence to Discharge Instructions Improves, Especially in Home Health Care Industry

Nationally, home health adherence climbed to 71.1%, exceeding pre-pandemic levels. Meanwhile, hospice and skilled nursing adherence fell slightly, underscoring ongoing challenges around staffing and care coordination.

Improved home health adherence demonstrates renewed trust in care-at-home solutions, and also shows potential for reduced hospital readmissions, a key metric for payers and health systems alike. Providers that invest in discharge planning and care continuity will reap both clinical and financial benefits.

There is a clear opportunity for home health providers to improve health outcomes and patients satisfaction, and reduce utilization through better post-discharge planning and caregiver engagement.

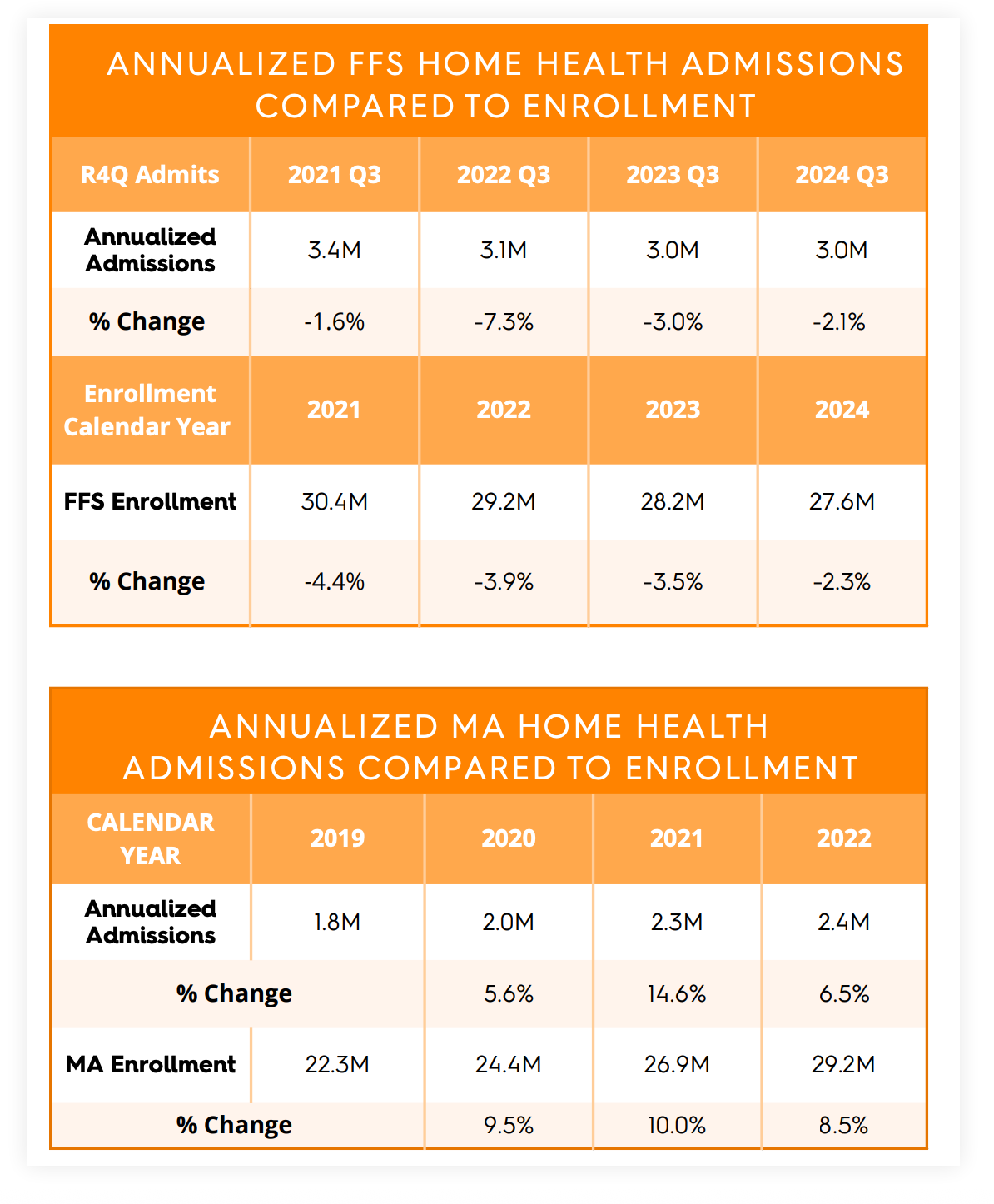

6. Home Health Admissions Reflect Changing Utilization Patterns

Though FFS home health admissions declined 2.1% between Q3 2023 and Q3 2024, this drop was less than the decline in FFS enrollment, suggesting growing preference for in-home care. On the MA side, admissions rose by 6.5% in 2022, despite slower-than-expected growth compared to enrollment increases.

This discrepancy may indicate a correction following pandemic-era spikes but also emphasizes the need for better payer-provider alignment in home health care contract terms and service value demonstration.

7. Utilization Remains Stable, But Regional Gaps Present Expansion Opportunities

Home health utilization held steady at 24.7% nationally, with a 25.1-point variation by state, underscoring uneven access and potential market gaps. High-performing providers are increasingly using this data to target expansion, not just based on competition, but on untapped demand in low-utilization areas.

Furthermore, patients adhering to discharge instructions experienced a 2.4 percentage point reduction in 30-day readmissions, reinforcing the impact of coordinated home health care in achieving value-based goals.

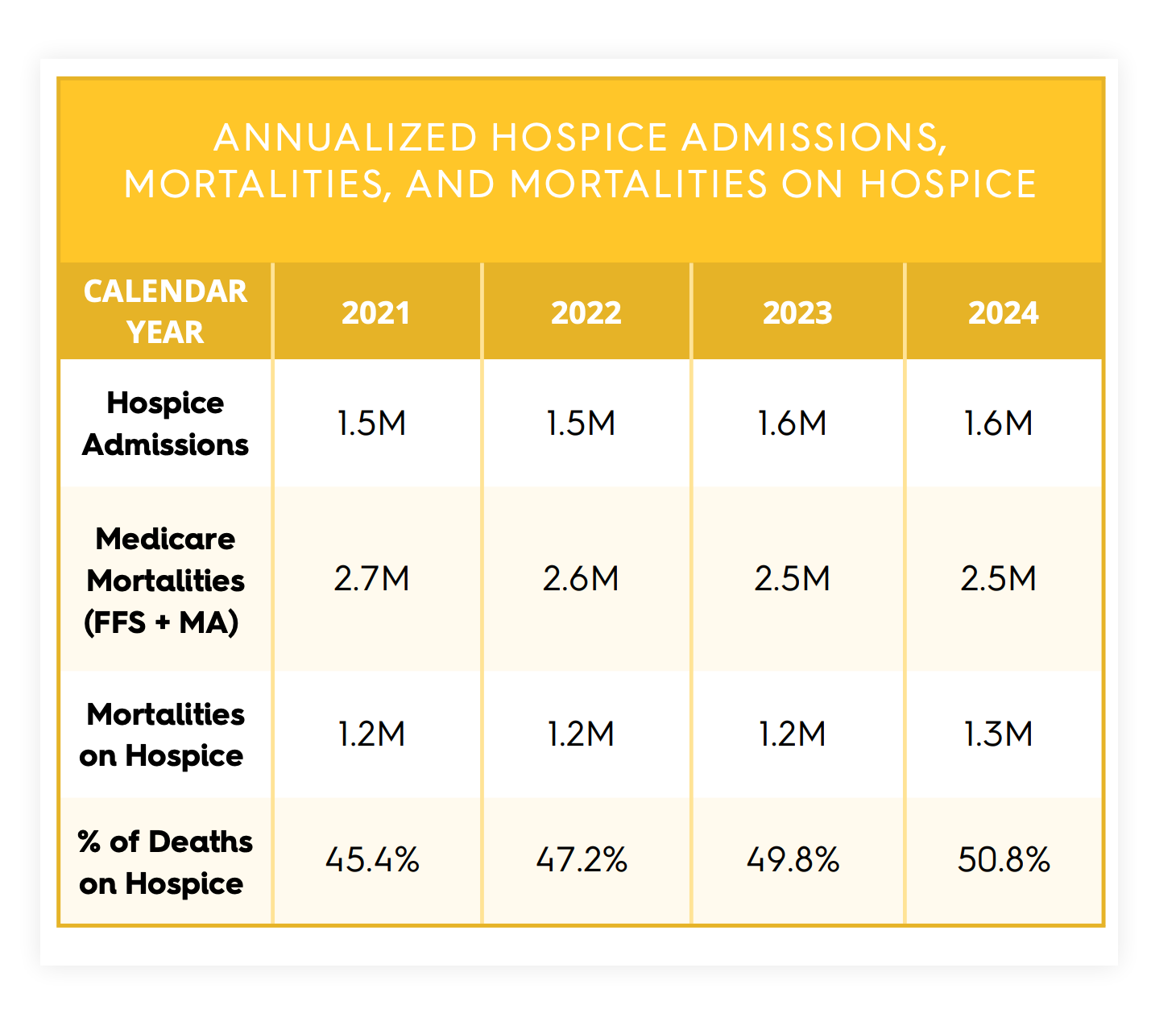

8. Hospice Utilization Surpasses 50% of Medicare Mortalities

Hospice care continues to gain ground, with 50.8% of Medicare mortalities now occurring on hospice, a symbolic milestone signaling greater awareness and acceptance of end-of-life care.

Additionally, average lengths of stay (ALOS) have increased, suggesting that earlier referrals are becoming more common, driven by greater recognition of the hospice benefit among both clinicians and families.

However, wide utilization disparities — ranging from 27.2% in New York to 65.5% in Utah — suggest further educational efforts are needed to ensure equitable access across regions.

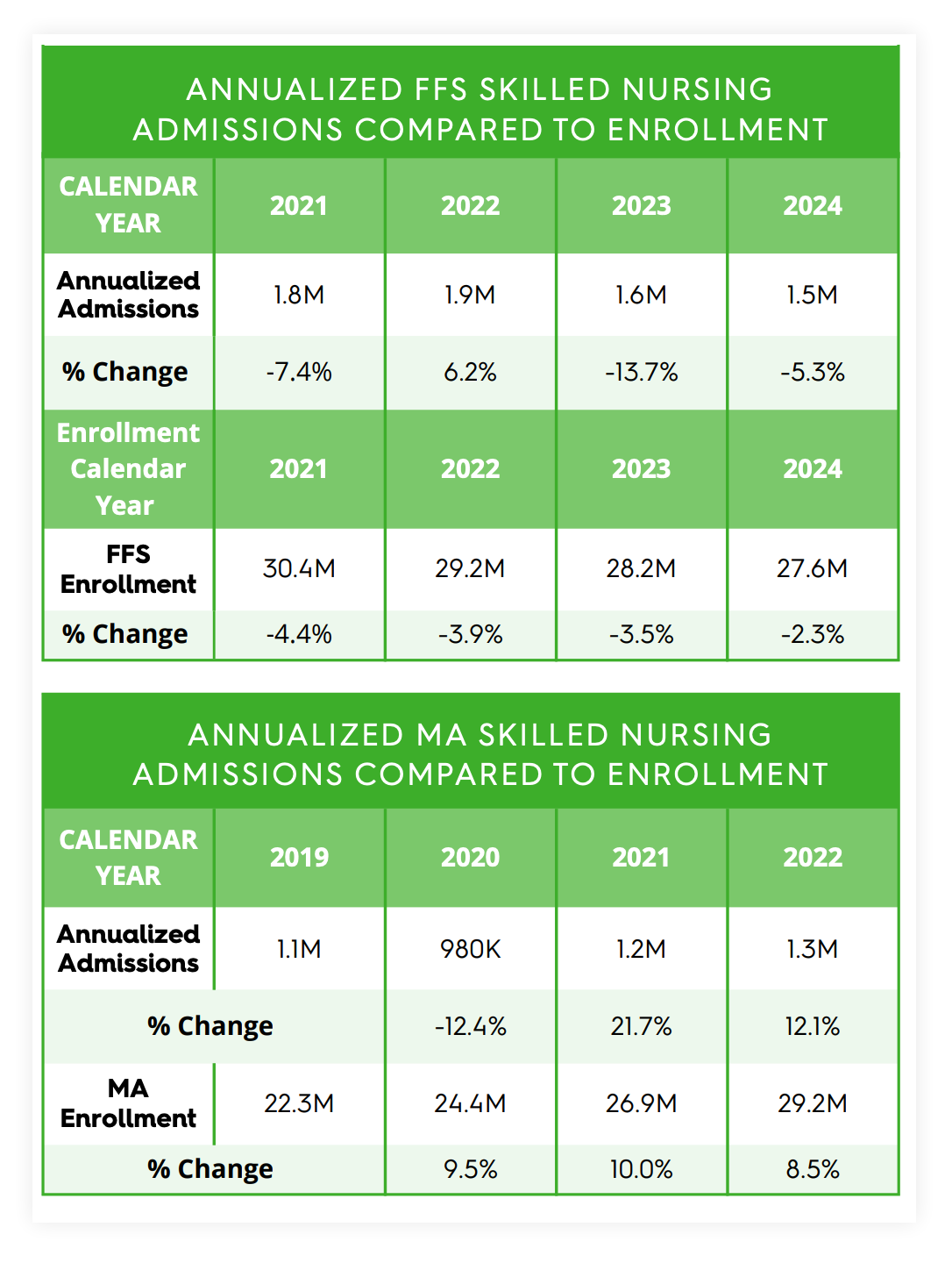

9. Skilled Nursing Admissions Show Signs of Stabilization

After years of decline, FFS skilled nursing admissions dropped 5.3% between 2023 and 2024, while admissions in MA began to stabilize. The 12.1% growth in MA SNF admissions between 2021 and 2022 suggests that utilization is slowly catching up to enrollment as network adequacy and clinical necessity align.

Skilled nursing facilities must clearly articulate their role in preventing readmissions, especially within value-based programs, and secure mutually beneficial MA contracts to ensure long-term sustainability.

10. Wide Variation in SNF Utilization Calls for Standardization and Strategy

Nationally, SNF utilization held steady at 22.7%, but ranged from 7.2% in Alaska to 29.7% in Connecticut. These disparities point to inconsistencies in discharge planning and highlight the need for evidence-based guidance to determine when skilled care is most appropriate.

As hospitals face increasing pressure to reduce readmissions and avoid unnecessary lengths of stay, SNFs that can position themselves as partners in complex patient care will gain a competitive edge.

Positioning for the Future of Post-Acute Care

The 2025 landscape demands that home health, hospice, and skilled nursing providers become data-driven, locally aware, and value-oriented. From MA expansion to utilization shifts and care coordination outcomes, the future of post-acute care will be defined by how effectively providers align with value-based care models, prove their impact, and adapt to regional dynamics.

To thrive, organizations must invest in technology, workforce development, and partnerships that elevate health outcomes and reduce fragmentation in care delivery across the healthcare industry.

Stay ahead of the curve — download Trella Health’s 2025 Post-Acute Care Industry Trend Report to explore more emerging trends shaping skilled nursing, home health, and hospice care strategy.