Ashton Harrison, Marketing Engagement Manager

With a diverse background of sales and healthcare marketing, Ashton manages Trella’s events, press releases, and media and association relations. After graduating from Florida State University with a major in communications, she began her career at Greenway Health, a EHR company, where she found her passion for the healthcare industry. At Trella Health, she’s able to do all the things she loves about marketing — engaging at events, interactions with partners, and creating marketing pieces that share insight on Trella’s journey.Webinar Recap: Insights and Predictions for the Home Health Industry

By Ashton Harrison | April 14, 2022

On our recent webinar with Home Health Care News, we paired up with Home Care Pulse to discuss the emerging market trends and predictions for the home health industry. The webinar speakers included Ellen Knowles, Trella Product Marketing Manager, Michael Neuman, Trella VP of Data Science and Engineering, and Todd Austin, Home Care Pulse President.

During the webinar, the speakers discussed Trella’s recently released 2021 Industry Trend Report, which analyzes how Medicare beneficiaries’ utilization of post-acute care services has changed over the last three years. We’ll recap the main discussion points from the webinar, including:

- Admissions, Utilization, and Adherence

- Staffing

- Mergers and Acquisitions

- Medicare Advantage

Admissions, Utilization, and Adherence

Home health admissions have been stabilizing below pre-pandemic levels. Let’s discuss the current trends and admission volume.

Neuman: Before the pandemic, home health was the top destination, but once the pandemic hit admissions immediately dropped off. As we progressed further into the pandemic, people became more open to having caregivers enter their homes and home health admissions started to climb back up. In 2020 Q2 to 2021 Q3, there was an increase of 2.4 percentage points. At the current state, we’re stabilized at pre-pandemic levels, but we question if we will begin to see growth again? Also noteworthy, home health adherence has not changed, but we’re seeing about 5% downward shift in-home health admissions.

There is a high demand for home health services, but that doesn’t guarantee an increase in admissions due to the impact of the labor market. How the market responds to those supply-side issues is what’s going to drive the admissions.

What qualitative changes do you see as having the potential for the greatest impact on admissions, utilization, and adherence?

Neuman: There’s going to be a focus on COVID-related home healthcare, and a lot of the changes we saw during the pandemic have permanently shaped the way that we provide care and the way that patients want to receive care.

We’re going to continue to see telemedicine and evolve those services, an increase in payments, and ensuring we have a way to track the quality outcomes for these patients that receive these services in their homes.

Austin: One of the big things identified from the pandemic was the need for behavior health and the shift to provide home-based behavioral healthcare. On the note of telemedicine, digital literacy due to the labor market and to scale accessibility. We’ll probably see an emphasis in rural areas that historically didn’t have access.

Staffing

What trends are you seeing specifically within the home health sector as it relates to staffing?

Austin: There’s a strategic framework called how to win and involves the five things to consider when thinking about staffing and your organizations winning aspiration. Your mission, vision, purpose, where you compete, and employment. You win by communicating what makes your employment opportunities unique and a attractive employment brand.

Companies are listening to their employees and providing solutions to give them a voice, build their career ladders, and providing more education to alleviate skill gaps and reduce mental fatigue.

Neuman: Organizations also need to evaluate the types of patients they’re treating in relationship to staffing issues to ensure staff has the right areas of expertise for patient needs. Digging into what diagnostic mix looks like for our patient base and starting to thin out areas where we aren’t seeing a lot of referral volume or the best outcomes. Your agency should focus on high value, high dollar, high-quality types of referrals. This is going to become more important as we begin to specialize and focus our agencies on what we do best.

Mergers and Acquisitions

What has acquisition activity looked like during pandemic and what does it look like now?

Austin: M&A activity slowed during the pandemic, and the longer the capital sits, the more pressure there is to get a return on that investment. M&A is back, and I think we’ll see some consistency over the next couple years, depending purely on what the market does from a worldwide perspective.

There’s a emphasis on evaluating employee engagement scores, because in addition to market share, the employment perspective is also evaluated to strategically intersect the employment brand and culture for the sake of the staffing challenges perspective.

Neuman: I think there’s a buying opportunity because this shift to home health has really accelerated. You see the smaller entities getting gobbled up by the larger corporate organizations because a lot of those smaller entities were not positioned to be able to compete in a competitive market. Consolidating could relate to a huge business upticks.

There is a continuing opportunity to be innovative around how organizations compete for services, acquisitions, and partnerships. There’s an incentive for organizations to compete on value by acquiring companies that will help your organization achieve lower cost outcomes and reduce the per-unit cost of delivering care.

Medicare Advantage

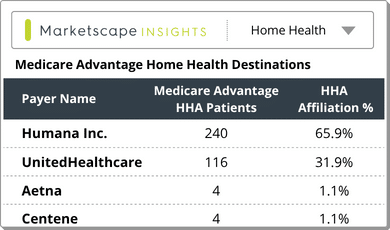

What are you seeing with regards to the continued expansion of Medicare Advantage as it relates to home health?

Neuman: Medicare Advantage is helping us move in the right direction and we’re expecting MA enrollment to exceed fee-for-service. We’ve got to start thinking about how we can provide value with our care and become the low-cost provider. Data, such as our patient mix and outcomes, will become even more telling as to which entities Medicare Advantage plans will want to work with.

Medicare Advantage really varies by geography. You find a high penetration in urban areas, such as California, where penetration rates are 65% and well above the national average, then others may only be 2% enrollment. As those urban areas become completely saturated, we’re gonna see a lot more focus heading towards the rural areas.

If you’re trying to approach a MA plan, prove your value by providing data that shows where you excel. Think of terms of readmission rates, quality, and costs and how you rank compared to other agencies. Also, specialization, and how you are the best partner for segments of the population in your market. Home health agencies are going to have to know their key performance indicators (KPIs) and their value proposition. when approaching a payer?

Austin: The HHBP program estimated $141 million savings per year since demonstrated in 2016. Agencies became aware of the savings and improvement and quality score. The first year of collection on performance data will be in 2023, and we’ll start to see payment incentives in 2025 and a bigger emphasis on KPIs and quality outputs.

What gets measured gets managed, so you must ensure you have the information you need to create the measurements and outcomes you’re looking for.

Conclusion

The overall census from the webinar is that there is a great opportunity for home healthcare, both now and in the future. The key takeaways are:

- Agencies need to know what types of conditions exist in their market to ensure they have the right staff in place

- Understanding the payer mix and what those plans are seeking is essential for determining how to get in-network

- Data is key to highlight your agencies outcomes and cost saving opportunites to show your value to partners

It is more important, now than ever, to have the right data to demonstrate how your agency lower costs and improves patient outcomes. To learn more about how Trella’s solutions provide insights on your market and agency, schedule a demo today.

To learn more about the latest post-acute insights and trends, check out our 2021 Industry Trend Report.