Carter Bakkum, Senior Data Analyst, Healthcare Insights

Carter is a senior data analyst who works to turn complex, messy data into actionable intelligence. Carter studied economics and statistics at the University of Virginia before joining an economic consulting firm, where he supported expert testifying economic witnesses on behalf of fortune 500 healthcare companies. After the significant changes in the importance of data analytics during the pandemic, Carter joined the Trella team to dive deeper into the numbers to uncover the stories that drive our experience.2021 Year in Review: COVID-19 Trends and the Post-Acute Care Industry

By Carter Bakkum | December 16, 2021

With 2021 coming to an end and 2022 fast approaching, it’s important to understand how the post-acute care industry has performed over the last few quarters. Year-end reviews are always critical to implementing effective strategies, but it is perhaps even more important to take a look back this year, in light of the effects of COVID-19 on post-acute care (PAC) in the US. As such, strategic decisions must be made for 2022 that take into account the current state of the pandemic and the trajectory of the post-acute care industry, locally, on a state level, and nationally.

Methodology

Using access to 100% of Medicare Part A and B claims data, Trella has followed the patient care pathways of nearly 1.6 million cardiac inpatient discharges and 666,000 reUsing 100% of Medicare Fee-For-Service (FFS) claims data and COVID-19 data published by the Centers for Disease Control (CDC), this blog investigates how utilization of home health, hospice, and skilled nursing services has changed temporally and geographically over the last few quarters of available data as well as correlations to the last few waves of COVID-19 the U.S. has seen.

Visualizing COVID-19 Trends Across the Post-Acute Care Market

Below, we have a time-lapse animation of COVID-19 cases by state over the last seven full quarters of available data (2020 Q1 – 2021 Q3), published by the CDC. States in dark green indicate a lower number of COVID-19 cases, and states in dark red indicate higher numbers of COVID-19 cases. States appearing in white have reported case numbers falling between the green and red extremes. We can easily see the two major waves of COVID-19 in Q4 2020 and Q3 2021 in the transition from green to either white or red.

This time-lapse is interesting in its own right. However, when we apply this information to trends in post-acute care admissions over the same timeframe, it becomes even more compelling – giving PAC providers a clearer view of how COVID-19 cases may impact their business.

If you click the right arrow in the bottom left of the Tableau dashboard below the chart will cycle through each quarter between 2020 Q1 and 2021 Q3.

National Admissions by Post-Acute Care Line of Business patient National Admissions by Post-Acute Care Line of Business

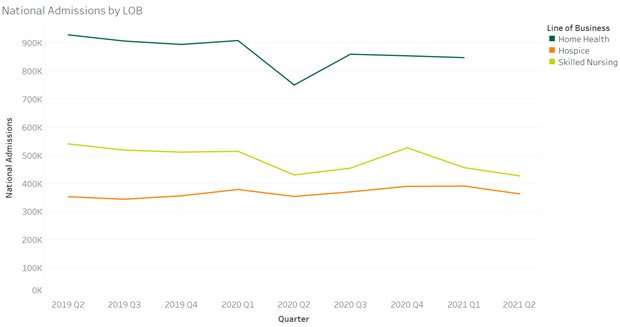

The next graph shows national Medicare fee-for-service (FFS) admissions broken out by post-acute care line of business between Q2 2019 and Q2 2021. As we explore this data, it should be noted that Q2 2021 claims information is incomplete for home health agencies and is excluded from this graph.

From this image, we can see that the quarterly admissions for home health, hospice, and skilled nursing facilities (SNFs) remained relatively stable, with the marked exception of a pronounced dip in Q2 2020 due to initial lockdowns in response to the pandemic. There is also a slight downward trend in home health and SNF admissions with a slight increase in hospice admissions, which is consistent with historic trajectories in all three markets.

In contrast with these expected results, one interesting increase appears in Q4 2020 for SNFs. Despite stable home health and hospice admissions, SNF admissions jumped significantly before decreasing to 2020 Q2 levels. This may be partially or entirely due to the first wave of COVID-19 cases, which occurred in the latter part of Q4 2020. We may be able to confirm or dismiss this theory when we obtain Q3 2021 data, illustrating industry trends around the second large wave of COVID-19 infections.

Admissions by State and Line of Business (LOB), 2019 Q2 – 2021 Q2

Finally, we have developed three time-lapse videos of home health, hospice, and skilled nursing admissions, adjusted for the Medicare FFS population, by state from Q2 2019 through Q2 2021. Again, because Q2 2021 home health admissions claims data is incomplete, we have excluded it from this analysis. Take a moment to interact with the graphic to get a view of how admissions have trended in your state and others. By clicking on a specific state, you can get a better view of COVID-19 infection trends in your market.

The maps below have the same functionality as the COVID-19 map above. Click the right arrow to cycle through admissions for each line of business between 2019 Q2 and 2021 Q2.

Next steps:

COVID-19 continues to impact PAC organizations across the United States. With 2022 just days away, PAC businesses must understand how the pandemic and infection rates have affected the industry and their local markets. Gaining a deeper understanding of COVID-19 infection rates, what they mean for your agency, and what you can expect moving forward will help you develop an effective strategy for the coming year.

Trella Health is the leader in market intelligence for the 65+ population, with extensive data sets including Medicare FFS, Medicare Advantage, commercial payers, ACOs, and DCEs. For more insights into how to stand out as a preferred referral partner, schedule a demo today.