BLOG

Referral Targeting Strategies Series: Competitor Affiliated Physicians

By: Teresa Buglione and Lauren Byers | November 6, 2020

Welcome to the third post in our blog series on the most common, effective, and efficient targeting strategies. We’ve already covered two methods for improving your referral relationships and growing admissions – underutilization and unaffiliated physicians.

As we dive into our third strategy, competitor affiliated physicians, we’re going to take a slightly different approach to identifying and speaking to physicians in your market. Because they already see the value in post-acute care, it’s less necessary to educate and more essential to persuade. So, let’s explore the delicate task of showing your organization’s strengths and performance metrics to help ensure patients get the right care at the right time and, most importantly, from the right agency.

Strategy 2: Competitor Affiliated

What it Means

At first glance, this strategy feels similar to unaffiliated physicians – after all, both groups’ patients are leveraging post-acute care, just not through your agency. The key difference with these physicians is that, while the unaffiliated group has no patterns or trends to their referral destinations, the competitor affiliated group does. These physicians send most of their patients to one or two particular agencies, meaning they may have an existing relationship with or preference for your competitor’s agency directly. Additionally, it could indicate that the physician has a strong alignment with a hospital that is affiliated with your competitor’s agency, resulting in a high number of patients being referred.

Why it Matters

If a physician is making these decisions based on personal preference or existing affiliations or alignments, they may be overlooking more critical factors in overall patient success. Their own personal or professional bias might be clouding their judgment, causing them to stick with what they know rather than exploring other agencies in the area.

And, because a post-acute agency’s staff, management, and/or procedures can change at any moment, so too can the quality of care the patients receive. By not regularly evaluating and comparing post-acute care agencies in the market, referring physicians might not notice a change in their patient outcomes for quite some time.

Key Metrics: Unaffiliated

Trying to turn the tide of affiliation is particularly difficult, primarily because there are so many different factors that play into their preferences. For example, a physician may also be the medical director of a hospice, meaning his referrals will most certainly be skewed. Or, if the hospital he works for also owns an agency, he’ll be encouraged – and potentially incentivized – to send his referrals there.

Before you can begin to build a case for your agency, you need to do your research to see if you can uncover any affiliations or known biases that may be influential to their referral decisions. Once you understand why they prefer one agency over yours, you can then start to explore the metrics that will prove why they should move. The stronger their affiliation with an agency, the more compelling your metrics need to be.

Competitive reports will be key when building a case for your agency. Look for the ways that your agency outperforms their primary affiliation in terms of both quality and scope of care. Focus on high-level metrics like readmission or hospitalization first. Are there any clear differentiators? Go a bit more granular as well – how do you compare on the types of care you provide and the types of care his patients typically need? If the physician has more high-acuity patients, does your agency provide more frequent visits? Or do you offer more variety in the place of care you provide? For hospice patients, many patients want the choice of in-home or facility care for their loved ones.

Speaking to Unaffiliated Physicians

As mentioned earlier, this conversation will be a harder one than with either unaffiliated or underutilizing physicians. They have an established relationship and you want to steer them in another direction. However good your intentions and reasonings are, you’re going to come up against objections – especially if they’re organizationally aligned. Focus on how, even though they may have a long-standing relationship with an agency, there may be providers in the market better suited for their patients’ needs.

Present Your Case

For competitor affiliated physicians, you have to find a balance between introducing the pain points of their current affiliated agency and highlighting your agency’s strengths. Here’s a sample presentation outline a home health agency could use to guide their conversation:

- What is the challenge you’re trying to solve?

Improve patient outcomes by diversifying their post-acute care destinations to the agencies best suited for their patients’ needs. - Why does this matter?

Although an agency may have performed well historically, things can change and it’s important to rely on actual outcomes instead of relationships alone. Basing their referral decisions on organizational alignments or personal preferences may result in their patients not getting the care best suited to their needs. - What are their metrics?

Assuming that a significant percentage of their Medicare patients received post-acute care and a clear affiliation with one or two agencies, you need to begin pulling key competitive metrics. Pull a competitive analysis for their existing affiliated agencies.- General performance metrics:

- Hospitalization

- Readmission

- Frequency of Care

- Types of Care (therapy vs nursing)

- Diagnostic-specific performance:

- Look at the physician’s patient mix. If there are patterns with the diagnostic categories they serve, drill down into these specific patient outcomes. Try to find examples of how their current affiliated agency misaligns with their patient needs.

- What is the total number of home health agencies that provided care to their patients?

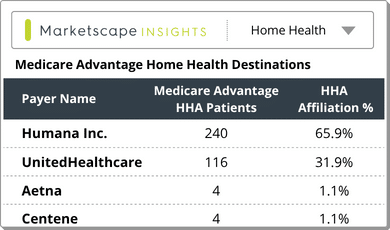

- Look for patterns in affiliation. If they seem to favor one or two destinations in your market over yours, they may be more affiliated with your competitors, requiring a different approach.

- Do the math!

How could they improve their practice’s overall patient outcomes by referring even a fraction of their patients to a better-aligned agency? Do the math that matters to the specific physician – if your readmission rate is even 2% lower than the competitor they’re currently using, that can make an impact. For example, if a physician refers 300 patients to home health each year, 6 more patients who don’t have to unnecessarily go back into the hospital. Now imagine how much of an impact switching to your agency could make on an even larger scale. - Show your metrics

Build your competitive story. Balance highlighting their weaknesses with your positive outcomes – but do so respectfully. A good strategy would be to start by identifying the specific diagnostic categories in which you outperform their existing affiliated agency. Build out a solid presentation showing an apples-to-apples comparison of you and their current agency. Make sure to focus on the metrics that matter most to this specific physician. This may not sway them to send you all of their referrals but could potentially influence where they send patients that need diagnostic-specific care. Taking a small step in building a relationship with this physician can open the door for more frank and honest conversations in the future. Start small and prove your value.

Next Steps

Patients often trust that their physician is recommending a specific agency because of their overall outcomes. But, by relying on existing relationships instead of looking at actual metrics, these physicians may be missing out on sending their patients to the right agency at the right time. Build a relationship with physicians in your market and begin to show them how valuable partnering with your organization can be for their patients – regardless of previous affiliations or organizational alignments.

Trella Health customers have access to all the metrics we discussed in this article. For more information on how to use Marketscape to identify underutilizing physicians or to create sales collateral, contact your Customer Success Manager or request personalized training.

If you’re interested in learning more about how Marketscape from Trella Health can help you improve patient care and increase admissions with this and other targeting strategies, schedule your personalized demonstration today.

Stay tuned for our targeting strategy series’ next installment, which focuses on specific diagnostic categories and how to approach them best. And come back soon to snag your copy of our Core Targeting Strategies Guide.

- General performance metrics: